Capital acquisition GST free item. 6 2 Tax Code.

How To Issue Tax Invoice Agoda Partner Hub

SST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system.

. The Malaysia Standard Industrial Classification MSIC search engine system or e-MISC was developed to facilitate the users to find the relevant industrial code. 6 10 Tax Code. Income Tax Payment excluding instalment scheme 7.

Defining sales tax reporting codes. Supplies of goods and services between connected persons. Explanation of Government Tax Codes For Purchases.

Guide on Accounting Software. List of Sundry Goods. On a wide range of goods at the point of import or at the.

Monthly Tax Deduction MTD 6. List of Approved Outlets. GST on purchases directly attributable to taxable supplies.

Betting and gaming supplies. It applies to most goods and services. This guide covers everything you need to know about Sales and Service Tax in Malaysia as a small business owner.

0 7 Tax Code. Malaysia GST Reduced to Zero. Here are some of the tax rates of countries around the world who have implemented GST or VAT.

Thats what this guide is for. Examples includes sale of air-tickets and international freight. For more information about tax code properties see Tax Code Properties.

A GST registered supplier can zero-rate ie. Supplies in relation to construction industry. 6 12 Tax Code.

On goods produced for sale outside the country. For more information regarding the change and guide please refer to. Supply of services where amount of consideration was not ascertainable.

Charging GST at 0 the supply of goods and services if they export the goods out of Malaysia or the services fall within the description of international services. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6.

Salts thereof Magnetic or optical readers nesoi. TX-N43 Tax Rate. 6 11 Tax Code.

The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity. GST code Rate Description. This guide includes everything you need to know about digital tax laws in Malaysia whether your customers live in Kuala Lumpur or Putrajaya.

Here is a list of GST codes and terms that comply with the Australian BAS. To understand how NetSuite uses the tax codes to get the values for the Malaysia GST-03 Return see What goes into each box - Malaysia GST-03 Return. Malaysia GST Reduced to Zero.

6 5 Tax Code. In Malaysia Sales and Service TaxSST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system. 0 6 Tax Code.

GST State Code List of India. Continuous supplies of services. In Malaysia our tax system involves several different indirect taxes.

0 4 Tax Code. While migrating to a GST registration or while going for a new registration most businesses would have received the 15 digit provisional ID or GSTIN Goods and Services Tax Identification Number. We use cookies and 3rd party services to recognize visitors.

Purchases with GST incurred at 6 and directly attributable to taxable supplies. 6 3 Tax Code. The GST report by configuration report takes advantage of reporting code functions in Dynamics 365 Finance.

For purchases with input tax where the GST registered entity elects not to claim for it. Sales tax reporting codes collect the information for several sales tax codes onto one report line. On goods brought into the country.

Yes if the purchase was made 3 months before the tourist departs from Malaysia. 0 9 Tax Code. Machines for transcribing data on data media in coded form and machines for processing such data nesoi.

0 8 Tax Code. The MSIC 2008 version 10 is an update of industry classification developed based on the International Standard of Industrial Classification of All Economic Activities ISIC Revision 4. GST code Rate Description.

TX-E43 Tax Rate. Capital acquisition GST item. In a typical setup there is one sales tax reporting code for every calculated field on reports and some predetermined.

Buprenorphine INN codeine dihydrocodeine INN ethylmorphine and other specified INNs. Code lookup malaysia Concentrates of poppy straw. 1 Government Tax Code.

GST on import of goods. GST List of Zero-Rated Supply Exempted Supply and Relief in Malaysia. The two reduced SST rates are 6 and 5.

The tax codes list window displays all the GST codes available in MYOB. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. No matter where you live or where your online business is based if you have customers in Malaysia you gotta follow Malaysian GST rules.

GST Guidelines on TRS. TX-RE Tax Rate. Accounting for GST.

Machines or devices operated by coins token etc. Knowing the structure of the GSTIN is crucial for a business - to ensure that ones suppliers have quoted the. Non-income tax deductible acquisition.

Input tax on purchases made from GST registered suppliers by local authorities or statutory bodies to perform regulatory and enforcement functions. Real Property Gain Tax Payment RPGT 5. Imports under special scheme with no GST incurred eg.

Search by MSIC 2008 Code Please insert at least 3 digits. Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to enhance your accounting software to be GST Compliant Draft as at 13 March 2014 TX. On the Tax Code page check the boxes of the properties that apply to the tax code.

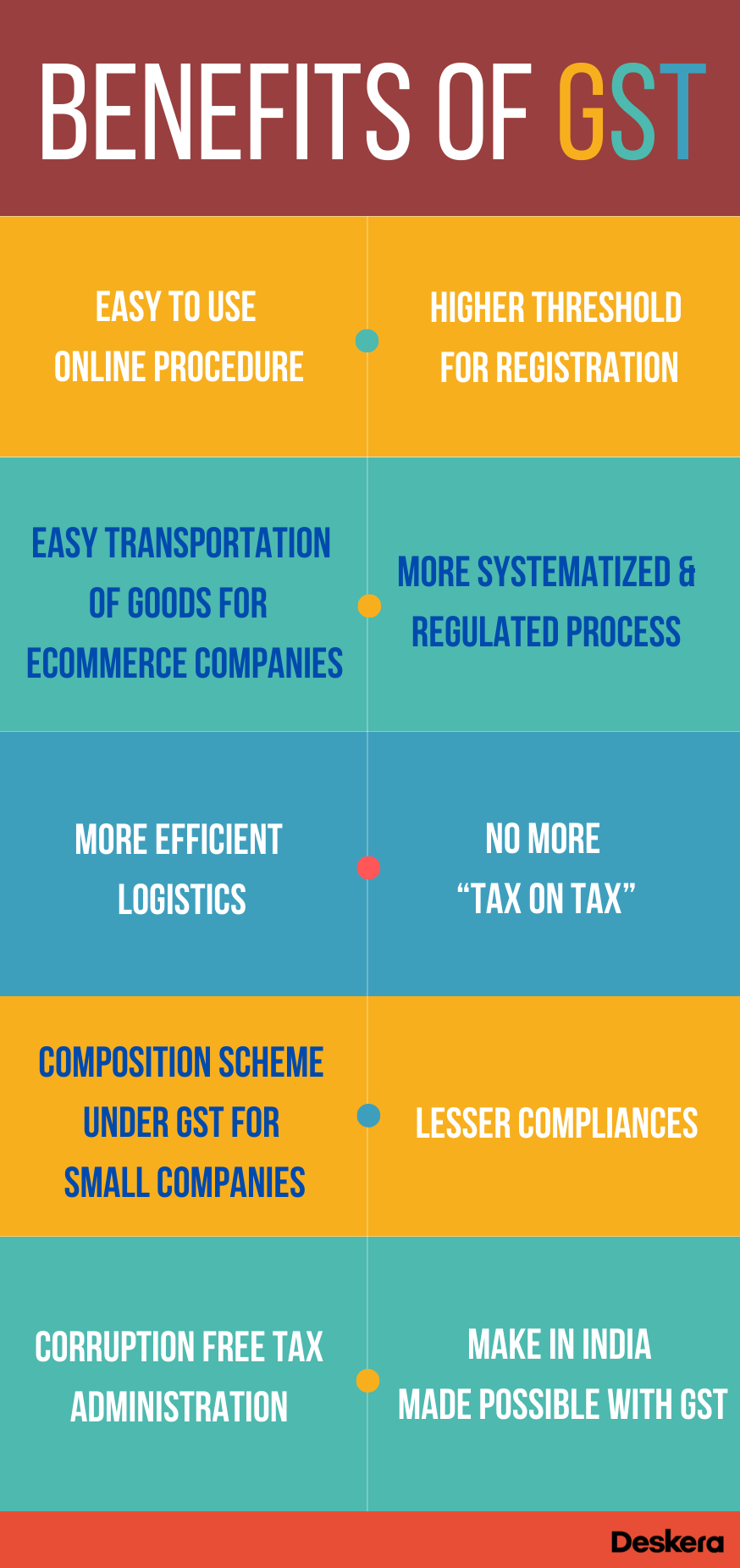

There are 23 tax codes in GST Malaysia and categories as below.

Casio G Shock Gst B200tj 1ajr G Steel Series 4549526268533 Ebay Casio Casio G Shock G Shock

How To Issue Tax Invoice Agoda Partner Hub

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

Gst State Code List 2022 Pdf Download Free

Malaysia Sst Sales And Service Tax A Complete Guide

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Chanel Sales Gst Black Caviar With Gold Hardware With Card Condition Good Rm 5990 Cash Price Promotion Only For Our Followers And Available At 114 Jalan

Documents And Procedures For Exporters Under Gst

Basics Of Gst Tips To Prepare Gst Tax Invoice

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

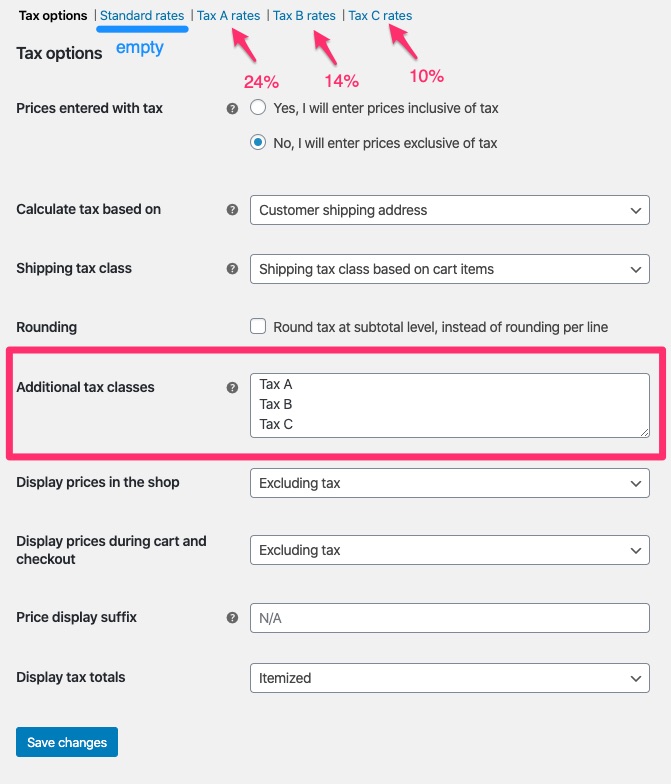

Setting Up Taxes In Woocommerce Woocommerce